UK on the Hitlist for Global Funds

Interesting to see a recent article in the EG, regarding the appetite from global property funds to acquire assets in the UK over the next 12 to 18 months, something that resonates with Wildbrook and our recent blog post ‘Outlook for 2024’.

Offices and retail, something that we were positive about in our recent blog post, have also been sectors that are now attracting attention from global funds as they look to seek value in an undervalued UK market.

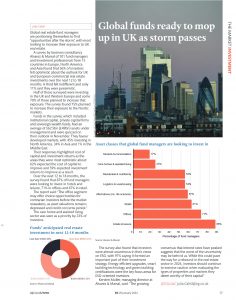

71% of respondents are keen to look at offices, as the ‘trough’ of the market may now have been met, in terms of re-based rents and also falling capital values.

The recovery and “rebound” suggested in the Alvarez & Marsal survey is similar to the outlook predicted by Wildbrook, and that this rebound will come prior to 2025.

The following were the key findings from the survey:

- Investor sentiment in real estate investment is improving.

- Hospitality is the most preferred asset allocation choice, with the tide turning for office space.

- Investments in developed countries favoured over emerging markets.

- ESG is increasingly important in real estate strategies.

There is a growing consensus that interest rates have peaked, which is giving investors something to look forward to, following a sluggish 2023. As the impact of higher rates works its way through the market and debt facilities mature, there will of course be a small level of distress seen but nothing like in previous more major events such as the GFC. The balancing act between risk and reward may make investors particularly cautious and discerning in the types of properties and markets they invest in, but the market sentiment in general is now more positive than the previous year which can only be a good thing for all.

We continue to work with clients that are looking to identify new investment acquisition opportunities and finding the sellers is the key to the 2024 market thus far.

The survey by Alvarez & Marsal, ‘An Outlook on Global Real Estate Investment: Finding Opportunities After the Storm’ can be found at the following link – An Outlook on Global Real Estate Investment Finding Opportunities After The Storm 2024.pdf (alvarezandmarsal.com)